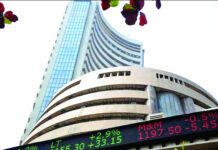

The rupee rebounded 25 paise to 68.33 against the US dollar in early trade Thursday, in tandem with other emerging market currencies after Federal Reserve chief Jerome Powell bolstered expectations of a rate cut later this month. However, rising crude oil prices capped the gains. At the interbank foreign exchange market, the domestic unit opened on a firm footing at 68.31, but soon pared some gains to trade at 68.33, up 25 paise over its previous close. The rupee had declined by 7 paise to close at 68.58 against the US dollar Wednesday, pressured by persistent foreign fund outflows and firming crude oil prices. US Federal Reserve Chair Jerome Powell told a congressional committee Wednesday that flagging global growth and trade tensions continue to weigh on the US economic outlook and the central bank is ready to “act as appropriate” to boost growth. Investors are wagering on a rate cut by the Fed as early as this month. Meanwhile, foreign institutional investors (FIIs) pulled out a net Rs 604.94 crore Wednesday, provisional data with the exchanges showed. Domestic equity benchmark BSE Sensex jumped over 200 points in early trade Thursday tracking strong cues from global markets following Powell’s remarks. The 30-share index, however, gave up some gains to trade 106.35 points, or 0.28 per cent, higher at 38,663.39 at 0930 hours. Similarly, the broader Nifty rose 33.80 points, or 0.29 per cent, to 11,532.70. The dollar index, which gauges the greenback’s strength against a basket of six currencies, slipped 0.23 per cent to 96.87. Brent crude futures, the global oil benchmark, rose 0.36 per cent to USD 67.25 per barrel amid reduced US inventories and geopolitical tensions. US oil producers have reduced output amid major storms in the Gulf of Mexico, while geopolitical tensions ratcheted up after Iranian boats reportedly tried to seize a British oil tanker in the Persian Gulf. The 10-year government bond yield was at 6.51 per cent in morning trade.

Dogra Herald is the media of J & K, breaking language and geographical barriers, connecting J & K to the rest of India.

0191 245 4946

info@dograherald.com

Latest articles

SEC notifies revision schedule for updation of Panchayat Electoral Roll-2024

DOGRA HERALD BUREAUJAMMU, Jan 12State Election Commission (SEC) has notified the dates for updation of Panchayat Electoral Roll-2024 in the UT of...

DC Poonch reviews arrangements for OMR based Panchayat Secretary Exam

DOGRA HERALD BUREAUPOONCH, Nov 29To ensure fair and smooth conduct of OMR based written examination for Panchayat Secretary posts, the Deputy Commissioner...

Fire breaks out in forest area in Doda

iamjkstarr - 0

A massive fire broke out in Compartment Number 33 of Forest Range Chiralla at Suie Gowari near Pul Doda. As per official sources, fire...