The Reserve Bank of India (RBI) on Friday cut repo rate for the fifth consecutive time this calendar year to 5.15 per cent from the current 5.4 per cent in a bid to support government measures for boosting economic activity amid benign inflation. The six-member monetary policy committee (MPC) headed by Governor Shaktikanta Das announced the decision after a three-day meeting. Earlier on February 7, April 4, June 6 and Aug 7, the central bank had reduced the key lending rate to infuse liquidity and push economic growth. Repo rate is the rate at which the RBI lends money to commercial banks. A repo rate cut allows banks to reduce interest rates for consumers and lowers equal monthly instalments on home loans, car loans and personal loans. India’s economy grew by only 6.8 per cent in 2018-19, according to government data. GDP growth slumped lower to 5 per cent in the April to June quarter as against a 8 per cent in the year-ago period due to weak household spending, muted corporate investments, and a crippling slowdown in manufacturing and construction activity. Industry leaders say a substantial cut in the repo rate and bank lending rates are needed to boost manufacturing and domestic demand for economic growth.

Dogra Herald is the media of J & K, breaking language and geographical barriers, connecting J & K to the rest of India.

0191 245 4946

info@dograherald.com

Latest articles

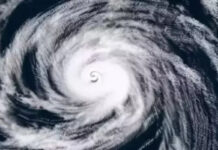

India registers 78,357 new coronavirus cases, tally crosses 37-lakh mark

iamjkstarr - 0

India recorded a single-day spike of 78,357 new coronavirus cases in the last 24 hours taking the tally past 37-lakh mark, according to the...

Hong Kong extradition Bill: What lies ahead?

iamjkstarr - 0

The adamant stand of the protesters and the city administration is only going to aggravate the crisis. ‘One country, two systems’, which allows Hong...

Israel says it bombed Hezbollah arms depots in Lebanon, group says it hit back

Tel aviv, Aug 21The Israeli military said on Wednesday it had bombed Hezbollah weapons storage facilities in Lebanon's Bekaa Valley overnight, and...