AGENCY

Beijing , Jan 28

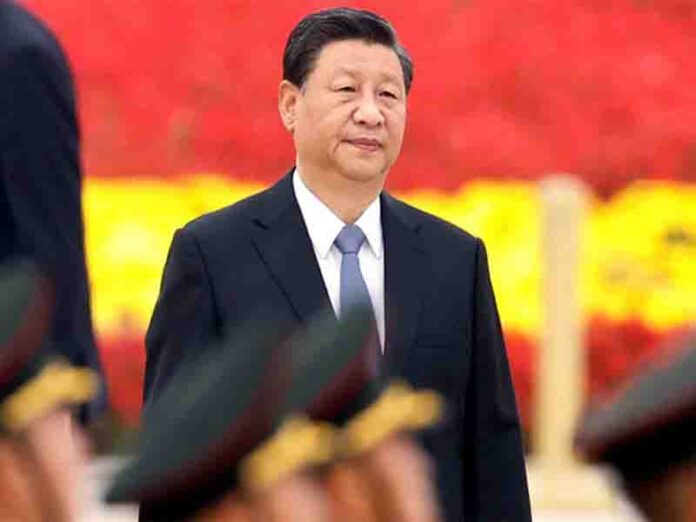

Donald Trump began his second presidency on January 20, 2025, prompting countries worldwide to brace for potential disruptions. Among the most watchful is China, whose leadership remains divided on how to approach another Trump term.

Yue Jie, a Senior Research Fellow at the Asia-Pacific Programme of Chatham House, stated, “The views from the Chinese strategic community range from tragically fatalistic to extremely optimistic as they prepare for Trump 2.0. At one extreme, some commentators expect bilateral relations to head for a freefall. At the other, pundits argue that Trump the dealmaker could do deals with China on sensitive issues, including Taiwan. Neither outcome is likely.” Ryan Hass, Director of the John L. Thornton China Center at the Brookings Institution, observed that Beijing seems more prepared this time. “Xi held a call with Trump that sounded constructive. Vice President Han Zheng attended Trump’s inauguration, a first. China’s spokesperson expressed interest…in strengthening cooperation and pursuing a new start to relationship.”

Hass further commented, “In 2017, Beijing was unprepared to deal with President Trump. In 2025, China’s leaders appear more organised. Will their plan work? Time will tell.”China is preparing for potentially volatile relations while strengthening ties with other global powers. “As a hedge, Beijing intends to fortify its international position via outreach to third parties. China is attempting to lower tensions with Japan, the EU, and others. And Xi and Putin met virtually to reaffirm their commitment to PRC-Russia relations.

The timing of the Xi-Putin virtual meeting to coincide with Trump’s inauguration carried symbolism. Both leaders seemed to want to signal a united front and an unwillingness to be split from each other by the US,” Hass explained.

Yue agreed with Hass, stating, “China’s efforts to manage the former property developer will seek to maintain a precarious balance aimed at saving its faltering economy and reversing the deterioration of relations with the US-led West, while also strengthening ties with large parts of the non-Western world. This balance is critical to China’s economic future and global standing.”

However, China’s internal challenges complicate its strategy. Recent months have seen the Chinese Communist Party (CCP) introduce measures to boost domestic consumption and support local governments, such as monetary easing and consumer subsidies. Yet, Yue noted, “Should [China] use increasingly limited financial resources to restore consumer confidence, or should it, as the CCP believes, instead promote technological progress and self-reliance?”

Trade wars remain a pressing concern. Yue remarked, “Beijing’s tactics will be different from what they were in Trump’s first term, as its macro-economic situation is less conducive to more strident retaliations on all fronts. Its punitive measures are likely to target sectors such as critical minerals, where Beijing enjoys a clear global monopoly.”

With ongoing trade tensions with the EU, entering another trade war with the US could strain Beijing further. Hass observed, “Given domestic challenges, Xi likely will not front-run US efforts, but his own politics will demand that he not be passive either.”